- Biz Brainstorms by Connor Gross

- Posts

- Living Rich, Moving Companies, Return on Hassle, Private Jets

Living Rich, Moving Companies, Return on Hassle, Private Jets

designed to be skimmed

Welcome to Biz Brainstorms –

My name's Connor.

I go down weekly rabbit holes of business ideas & lessons. Then I package them into a 200 second email.

QUICK NOTE – I’ve been in Vietnam & Japan the last 2 weeks so this is slightly longer than usual. Skim at your leisure.

Today's Outline:

💰 Living Rich

👩🌾 Net Jets For Farming

⏰ Return on Hassle

🍰 Piece Of Cake Moving

🇨🇴 Pablo Escobar

Did someone forward you this email? If so, you can subscribe below:

💰 Living Rich

So much energy is spent trying to get rich.

The paradox of money is that it’s usually people who are the best at making it that are the worst at spending it.

That’s why I love people like Cole.

Cole gave 4 ways he spends his money to make his life better and give him more time back.

Hires I've Made in 2023 That Have Changed My Life:

House Manager ($1,200 / Month)

- 3 Hours Per Day At House

- Dishes, Laundry, Cleaning, Organization, Errands, GroceriesChief of Staff ($80,000 / Year + Bonuses)

- Lives in Toronto, CA

- Source & Staff

- Attends Meetings… twitter.com/i/web/status/1…— Cole Ruud-Johnson (@coleruudjohnson)

7:11 PM • Jul 31, 2023

Summary:

Cole spends ~ $17,866/month to make his life easier & business more productive.

I’ll admit, I can be cheap af.

But in the last 2 years I’ve learned the ROI that comes from both network & delegation.

If you’re a high earner, start outsourcing in simple ways (grocery delivery, Overseas VA to book travel, laundry pick up service, etc.)

👨🌾 NetJets for Farming

NetJets is a fractionalized private jet ownership company.

They sell access to people who are rich but can’t afford their own Private Jets, but still want to charter a PJ for their trip.

In 1998, they sold to Berkshire Hathaway for a cool $725 million.

In 2022 they did $2.7 billion in sales.

(Buffet the king once again)

But it raises the question – are there other things that the top 0.0001% own that the top 1% would pay for if they could own it in more affordable way?

I found this idea on Twitter and love it:

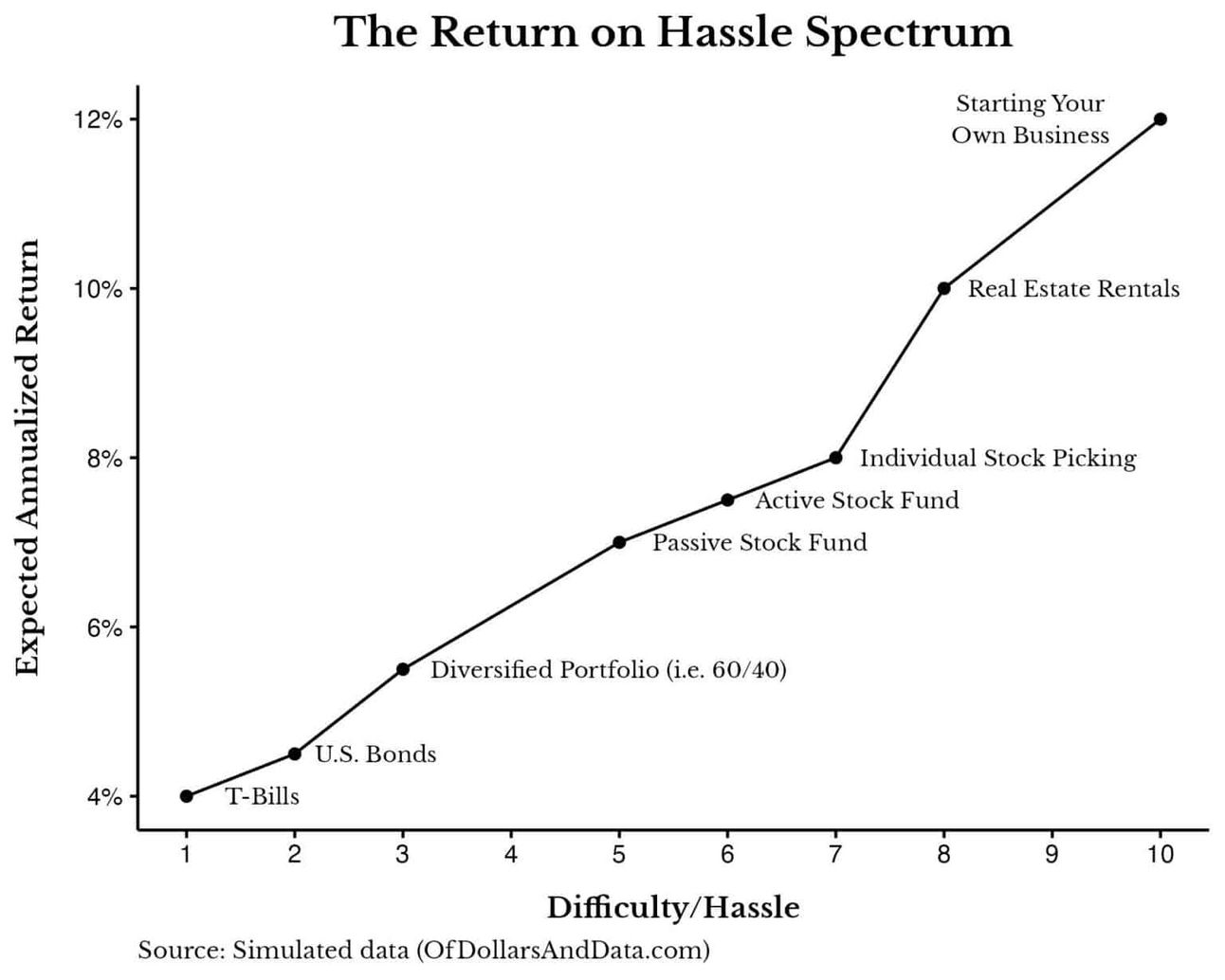

📖 Return on Hassle

Here’s something I CAN’T STAND:

People who preach financial knowledge but spend hours day-trading stocks or “house hacking”.

An example below that I stole from the Of Dollars & Data Blog:

Oooffff…

Listen, I respect hustle just as much as the next guy.

And of course there is upside here in appreciation and paying down the debt to build equity.

But between finding properties, inspections, managing tenants, toilets breaking… this is a ton of work for little upside.

And for what it’s worth, in 30 years with zero appreciation, they will have $3M in equity. So, kudos to them.

But I really like Nick Maggiullis piece on Return on Hassle

When deciding what to work on, the ratio between money earn & headaches created is so important.

🍰 Piece of Cake Moving

If you live in NYC, you have definitely seen this truck before.

Their branding is fantastic but what makes them truly amazing is their operations & support team.

I’m moving apartments in NYC this week and it’s so clear to me that they have highly trained overseas employees that are giving (no exaggeration) under 60 second response times.

I got a full quote to move in under 10 minutes.

I’m becoming increasingly excited by the opportunity to find small businesses and replace their staff with improved overseas operations that 10x response time and connection rate.

🇨🇴 Pablo Escobar

Just learned Pablo Escobar was making $400M+ a week at his peak

A WEEK 🤯

— Pierce (@pierce_mcm)

2:13 AM • Aug 7, 2023

For context, Nike made $850M/week last year.

✌️ See you next week

-Connor

PS – I love helping people build their companies/ lives they want to live.

2 ways I can help you do that:

I launched How To Quit Your Job & Not Run Out of Money. It’s over an hour of content, 80+ slides, spreadsheets, step-by-step plans on how to go from W2 to self employed.

I’ll be in NYC for the next 2 weeks so I can do consulting calls again. If you book a 1:1 for that, I’ll include the How To Quit Your Job Product for Free here. Schedule that here.

PPS – Went on Millenial Investing podcast last week. Worth the listen here.